The Benefits and Importance of Financial Derivatives in the Agricultural Industry

Introduction

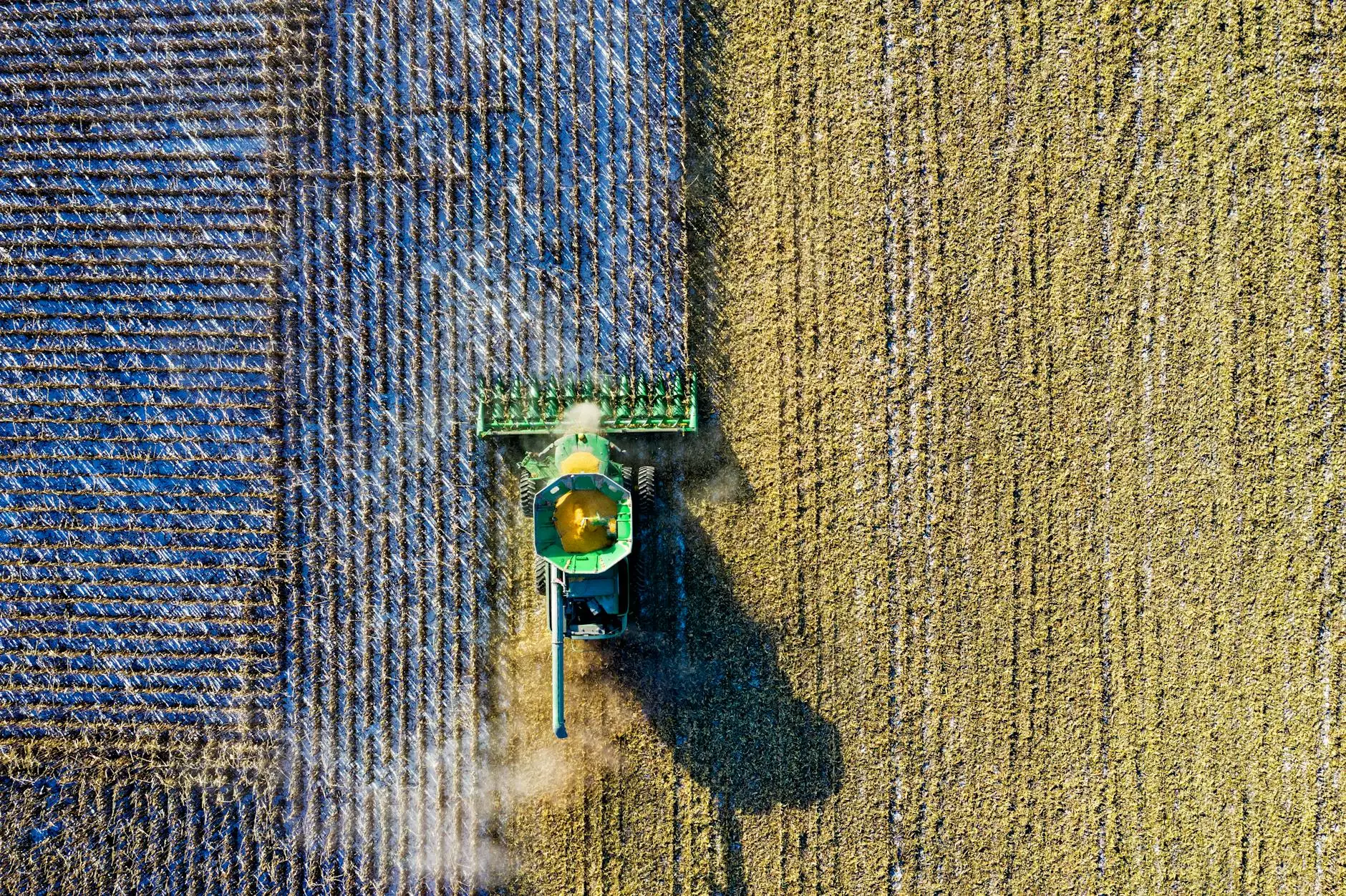

Welcome to Lucas Orchard's Farmers Market, where we believe in exploring innovative solutions to enhance the prosperity of farmers. In this article, we delve into the world of financial derivatives and their impact on the agricultural industry. By understanding and utilizing derivatives strategically, farmers can effectively manage risks, stabilize incomes, and optimize their operations.

Understanding Financial Derivatives

Financial derivatives are financial instruments whose value is derived from an underlying asset, such as commodities, stocks, or bonds. They serve as contracts between two parties, where the value fluctuates based on the price movements of the underlying asset. Derivatives offer various risk management opportunities for farmers, helping them navigate price volatility and uncertainty in the market.

The Role of Derivatives in Agriculture

Derivatives play a crucial role in the agricultural industry by providing farmers with tools to mitigate potential risks and uncertainties. Here are some key benefits:

1. Hedging Against Price Volatility

Price volatility is a significant challenge for farmers, as it can impact their profitability and financial stability. Through derivatives, farmers can hedge against price fluctuations by locking in future prices for their produce. This allows them to protect their income from unexpected changes and to plan their operations more effectively.

2. Managing Input Costs

Derivatives also assist farmers in managing their input costs, such as fuel and fertilizers. By utilizing derivatives linked to the prices of these inputs, farmers can guard against sudden price hikes, ensuring a more reliable budgeting process and minimizing potential financial strains.

3. Financing and Investment Options

Financial derivatives provide farmers with additional financing and investment opportunities. For instance, farmers can use derivatives to secure loans, leveraging their anticipated future income. This allows them to access capital for expanding their operations or adopting new technologies.

4. Diversification

Derivatives enable farmers to diversify their risk exposure. By using options and futures contracts on various commodities, farmers can spread their risks across different markets, safeguarding their financial well-being even in the face of localized issues or crop-specific challenges.

The Importance of Financial Literacy

While derivatives offer tremendous benefits, it is critical for farmers to have a comprehensive understanding of these financial instruments before engaging in derivative transactions. At Lucas Orchard's Farmers Market, we emphasize the importance of financial literacy by providing educational resources and workshops to empower farmers with the knowledge needed to make informed decisions.

Conclusion

Financial derivatives are invaluable tools for farmers in managing risks, ensuring stability, and maximizing profits. At Lucas Orchard's Farmers Market, we recognize the significance of derivatives in the agricultural industry and strive to offer our farming community the support they need to navigate the complexities of the marketplace successfully.

By leveraging the potential of financial derivatives, farmers can confidently face market uncertainties, seize opportunities, and build a sustainable farming business. Visit Lucas Orchard's Farmers Market today and discover how derivatives can revolutionize your approach to agriculture!

what are financial derivatives